|

||||||||

|

||||||||

Conservation EasementsWhat are Conservation Easements?The most traditional tool for conserving private land, a "conservation easement" (also known as a conservation restriction) is a legal agreement between a landowner and a land trust or government agency that permanently limits uses of the land in order to protect its conservation values. It allows landowners to continue to own and use their land, and they can also sell it or pass it on to heirs. When you donate a conservation easement to a land trust, you give up some of the rights associated with the land. For example, you might give up the right to build additional structures, while retaining the right to grow crops. Future owners also will be bound by the easement's terms. The land trust is responsible for making sure the easement's terms are followed. This is managed through "stewardship" by the land trust. Conservation easements offer great flexibility. An easement on property containing rare wildlife habitat might prohibit any development, for example, while an easement on a farm might allow continued farming and the addition of agricultural structures. An easement may apply to all or a portion of the property, and need not require public access. Qualifying for A Tax DeductionA landowner sometimes sells a conservation easement, but usually easements are donated to a land trust. If the donation benefits the public by permanently protecting important conservation resources, and meets other federal tax code requirements, it can qualify as a tax-deductible charitable donation. Easement values vary greatly; in general, the highest easement values result from very restrictive conservation easements on tracts of developable open space under intense development pressure. In some jurisdictions, placing an easement on your property may also result in property tax savings. Reducing Estate TaxesPerhaps the most important benefit, a conservation easement can be essential for passing undeveloped land on to the next generation. By removing the land's development potential, the easement typically lowers the property's market value, which in turn lowers potential estate tax. Whether the easement is donated during life or by will, it can make a critical difference in one's heirs' ability to keep the land intact. "Conservation Easements." Land Trust Alliance. Land Trust Alliance, 1 Jan. 2014. Web. 10 Nov. 2014. Conservation Easements Protect Land for Future GenerationsA CONSERVATION EASEMENT IS A RESTRICTION PLACED ON A PIECE OF PROPERTY TO PROTECT ITS ASSOCIATED RESOURCES. The easement is either voluntarily donated or sold by the landowner and constitutes a legally binding agreement that limits certain types of uses or prevents development from taking place on the land in perpetuity while the land remains in private hands. Conservation easements protect land for future generations while allowing owners to retain many private property rights and to live on and use their land, at the same time potentially providing them with tax benefits. In a conservation easement, a landowner voluntarily agrees to sell or donate certain rights associated with his or her property - often the right to subdivide or develop - and a private organization or public agency agrees to hold the right to enforce the landowner's promise not to exercise those rights. In essence, the rights are forfeited and no longer exist. An easement selectively targets only those rights necessary to protect specific conservation values, such as water quality or migration routes, and is individually tailored to meet a landowner's needs. Because the land remains in private ownership, with the remainder of the rights intact, an easement property continues to provide economic benefits for the area in the form of jobs, economic activity and property taxes. A conservation easement is legally binding, whether the property is sold or passed on to heirs. Because use is permanently restricted, land subject to a conservation easement may be worth less on the open market than comparable unrestricted and developable parcels. Sometimes conservation easements will enable the landowner to qualify for tax benefits in compliance with Internal Revenue Service rules.

"What Are Conservation Easements?" The Nature Conservancy. The Nature

Conservancy, 1 Jan. 2014. Web. 10 Nov. 2014.

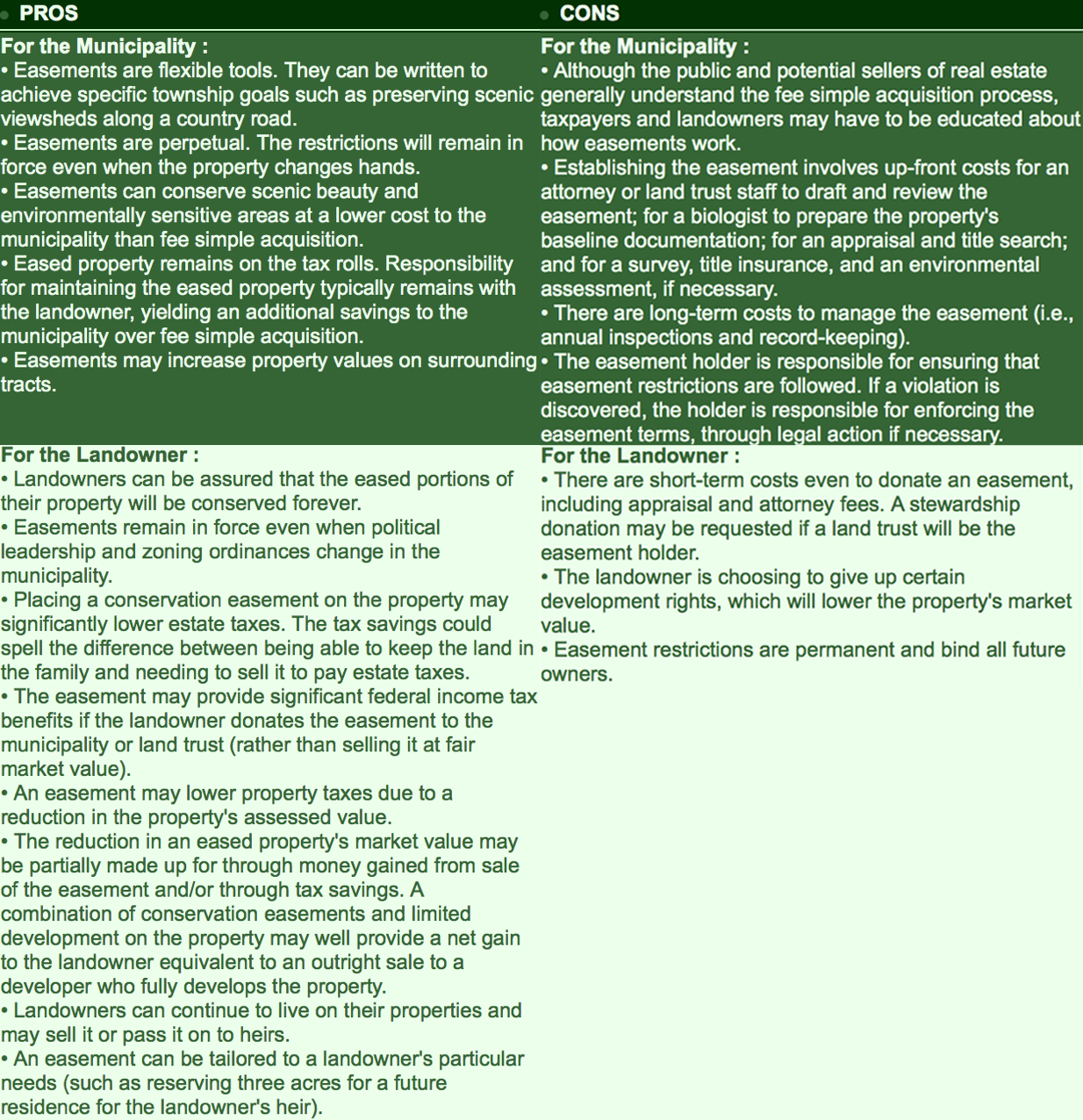

More Pros and Cons (from the National Center for Public Policy Research) Conservation Easements in Oregon

Conservation Easements in the News

Notable Conservation Groups in Oregon

NOTE: The latter three groups are part of the Earthshare Oregon coalition. |

||||||||

|

Home • About Us • Market • Activities • Donate |

||||||||

| About Helvetia • Directory • Volunteer! • Contact us | ||||||||

|

Web site design and programming by Brian Beinlich

•

Contact the webmaster |